Beijing, June 25, 2024

As the type, quantity, and importance of assets on the cloud continue to rise, so does their allure to cyber attackers, with mining Trojans, crypto ransom, data leakage, and APT attacks becoming increasingly rampant. As a result, network security products and services are assuming an increasingly important role in enterprise operations and development, and cloud workload security products are an essential component.

IDC officially released two cloud workload security market share research reports in June 2024, namely: "China Public Cloud Workload Security Market Share, 2023: Growing with the Cloud, Deeply Converged" 《中国公有云云工作负载安全市场份额,2023:伴云生长,深度融合》(Doc# CHC51233524, June 2024) and "China Private Cloud Workload Security Market Share, 2023: CNAPP Enables Enterprises to Realize Comprehensive Cloud-Native Security Protection" 《中国私有云云工作负载安全市场份额,2023:CNAPP助力企业实现全方位云原生安全防护》(Doc# CHC51544624, June 2024) The report provides a detailed study on the size, growth rate, key players, and market and technology trends of China's public and private cloud workload security market in 2023, respectively.

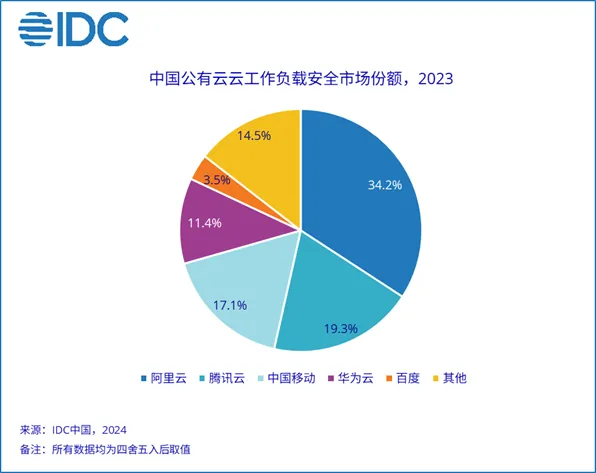

China Public Cloud Workload Security Market: $990 Million by 2023, Growing at 26.8% Y-o-Y

See the chart below for details:

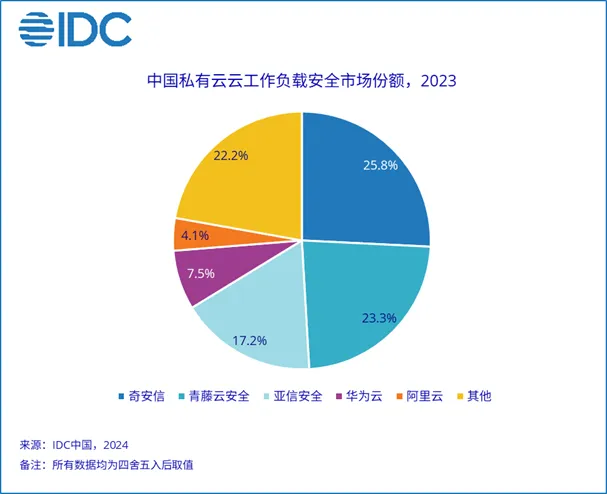

China Private Cloud Workload Security Market: $1.53 Billion by 2023, Growing 3.5% YoY.

See the chart below for details:

IDC believes that technology service providers should focus on the following trends:

Artificial Intelligence (AI) further deepens its application in cloud workload security products, and the security grand model significantly improves host security operation efficiency

The rapid development of GenAI technology has helped the security model to rapidly land in multiple business scenarios, including security operations and threat intelligence analysis, which not only improves the daily work efficiency of security operations personnel, but also greatly helps enterprises lacking professional security personnel to conveniently access security knowledge and intelligence analysis, and significantly improves their ability to analyze and dispose of security incidents.

Unified management capabilities for multi-cloud, hybrid cloud workload security

Trends such as edge cloud, proprietary cloud, industry cloud, and multi-cloud deployment are driving China's cloud computing market toward decentralization. Enterprises want to unify the management of all workloads in multi-cloud and hybrid cloud environments through a single management and control platform, reduce security operation and maintenance complexity, and improve the unity of asset management and consistency of security policies.

Container Security Becomes New Market Growth Area, serverless Gets Attention

The development of containers and Kubernetes will bring some unique security challenges. Modern application development requires the ability to continuously secure application security, vulnerability assessment, and configuration checking during the development, deployment, and operation of an application. At the same time, along with containers and serverless being used in large numbers, organizations are gradually increasing their focus on container security.

CNAPP Helps Enterprises Build Comprehensive Cloud-Native Security

Major domestic CWPP technology providers have launched distinctive CNAPP solutions, relying on the original CWPP market to expand cloud-native security protection capabilities on the one hand; on the other hand, through various types of scenario-based adaptations to continue to explore and cultivate new customers, and strive to maintain an advantage in the white-hot competition in the cloud workload security market.

The importance of security services is rising

A large number of small and medium-sized enterprises in the public cloud often have weak security operation capabilities, and they need to use the SaaS security services of public cloud service providers to realize unified security protection for cloud workloads, and to be assisted by cloud network security experts in responding to and disposing of network threats. For key industry enterprises on the private cloud, they need to quickly respond to and dispose of network threats through professional workflows and security tools, and provide sufficient resource support for security during key periods or important events.

Zhao Weijing, senior research manager of China's cybersecurity market at IDC, said that due to the uniqueness of the development of China's cloud computing market, the major players in cloud workload security in public and private cloud scenarios present different camps. 2023 China's public cloud workload security market will still be the major domestic public cloud service provider occupying the absolute leading position; the Chinese private cloud workload security market competition has further intensified. Competition in the market has further intensified, and the major players in the market have been enhancing their brand competitiveness through various means, such as technology stack expansion, specialized scenario coverage, price adjustment, sinking market development, etc. CNAPP, container security, and agent-less model have become the new driving forces for future market growth.