Since 2023, the global geopolitical landscape has become increasingly tense, leading to a more severe cybersecurity environment. DDoS attacks, known for their low cost and high returns, have become the preferred choice for many attackers, resulting in a continuous rise in global DDoS incidents. Products and services related to DDoS mitigation have become essential infrastructure for many organizations to maintain stable and secure business operations. According to the IDC Global Cybersecurity Services Survey, 35% of CIOs worldwide consider DDoS mitigation crucial for their organizations' cybersecurity defenses, with 20% planning to increase their investment in this area. IDC's "Global Application Protection Forecast, 2023-2027" predicts that by 2027, the global market for DDoS mitigation products and services will reach $2.64 billion, with a compound annual growth rate of 11.8%, indicating steady market growth.

Against this backdrop, IDC has officially released two reports: "IDC MarketShare: China Anti-DDoS Hardware Market Share, 2023: Sharpening Products, Advancing Bravely" 《IDC MarketShare:中国抗DDoS硬件市场份额,2023:磨砺产品,攻坚前行》(CHC50966024, May 2024) and "IDC MarketShare: China Public Cloud Anti-DDoS Market Share, 2023: Secure Sailing, Seizing New Market Opportunities" 《IDC MarketShare:中国公有云抗DDoS市场份额,2023:安全出海,把握市场新机遇》(CHC51233624, May 2024). These reports provide a detailed analysis of the scale, growth rate, key players, and market and technology trends in the Chinese anti-DDoS hardware and public cloud anti-DDoS services markets in 2023.

IDC MarketShare: China Anti-DDoS Hardware Market Share, 2023: Sharpening Products, Advancing Bravely (《IDC MarketShare:中国抗DDoS硬件市场份额,2023:磨砺产品,攻坚前行》)

IDC data reveals that in 2023, the market size for anti-DDoS hardware security products in China was approximately 670 million RMB, with a year-on-year growth rate of 4.3%. Various factors, including economic downturns, have slowed overall growth. Despite this, Huawei, NSFOCUS, DPtech, CNZXSoft, and H3C have maintained dominant positions in the fiercely competitive market. The specific market shares for 2023 are detailed in the chart below:

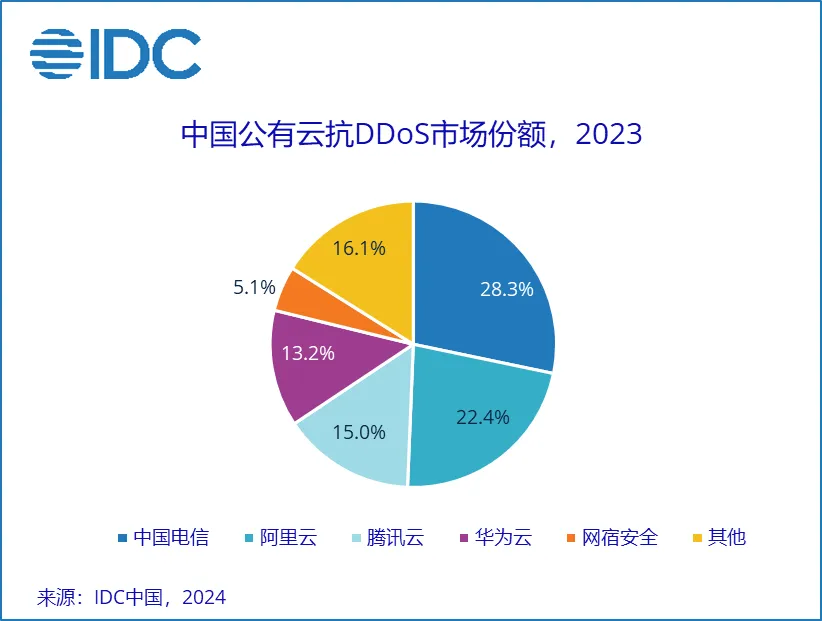

IDC MarketShare: China Public Cloud Anti-DDoS Market Share, 2023: Secure Sailing, Seizing New Market Opportunities(《IDC MarketShare:中国公有云抗DDoS市场份额,2023:安全出海,把握市场新机遇》)

IDC data shows that in 2023, the market size for public cloud anti-DDoS services in China was approximately 2.2 billion RMB, with a year-on-year growth of 15.8%. In addition to domestic business, various technology service providers have actively expanded overseas, achieving notable results in international markets. China Telecom, Alibaba Cloud, Tencent Cloud, Huawei Cloud, and CDNnetworks have secured leading positions in this competitive landscape. The specific market shares for 2023 are detailed in the chart below:

As a mature market, the anti-DDoS products and services sector is becoming increasingly concentrated, with heightened competition. IDC offers the following recommendations to help technology service providers navigate market changes and secure their market positions:

Deepen User Engagement and Iterate Products: Service providers should continuously enhance product performance (throughput, latency, security, reliability) and features (Layer 3-7 attack defense) based on user needs. Notably, "integrated security" will become an essential capability, enabling users to build effective defense systems. This includes extensive application edge protection (integrating Layer 7 anti-DDoS, WAF, API security, bot protection) and comprehensive network security defenses (integrating firewalls, intrusion detection and prevention, zero trust network access, secure access service edge, threat intelligence).

Empower Users with "AI+DDoS": Products and services leveraging AI technology to analyze and learn from traffic characteristics and attack behaviors can develop defense algorithms, strategies, and models tailored to user needs. This approach will enhance DDoS defense efficiency and effectiveness. Additionally, generative AI technologies can assist users in addressing basic DDoS mitigation issues, optimizing customer experience, and addressing the shortage of cybersecurity professionals, thus achieving cost reduction and efficiency improvement.

Enhance DDoS Defense with Security Services: Leveraging comprehensive analysis and response platforms like Security Operations Centers (SOCs) to deliver expert capabilities and experience to end users is crucial for building a closed-loop DDoS defense system. Expert support also helps end users respond to large-scale DDoS attacks swiftly, improving emergency response capabilities.

IDC China Senior Market Analyst Wang Yiting notes that DDoS attacks have increasingly become the preferred method for many attacker groups due to their low cost, high impact, and lucrative returns. The frequency, scale, and complexity of these attacks are continuously rising, making DDoS protection increasingly challenging for enterprises. In this context, end users are demanding higher throughput, lower latency, and more efficient threat detection and response from DDoS mitigation products and services. For service providers, improving product performance, optimizing defense algorithms and strategies, integrating related security products, and enhancing support services are critical. Moreover, keeping pace with national strategies and exploring international markets will become new growth points for the DDoS market. In the future, service providers that focus on market trends, user needs, and product development will deliver more tailored solutions and gain market recognition amid fierce competition. IDC will continue to monitor this market closely.