Beijing, August 9, 2024

International Data Corporation (IDC) recently released the 2024 V2 edition of IDC Worldwide Security Spending Guide《全球网络安全支出指南》.IDC data shows that total global cybersecurity IT investment will be $215 billion in 2023 and is expected to increase to $373.29 billion in 2028, a five-year compound growth rate (CAGR) of 11.7%. billion in 2023 and is expected to increase to $373.29 billion in 2028, representing a five-year compound growth rate (CAGR) of 11.7%. Global cybersecurity spending is slightly lower compared to the previous forecast due to geopolitics, macroeconomics and epidemics.

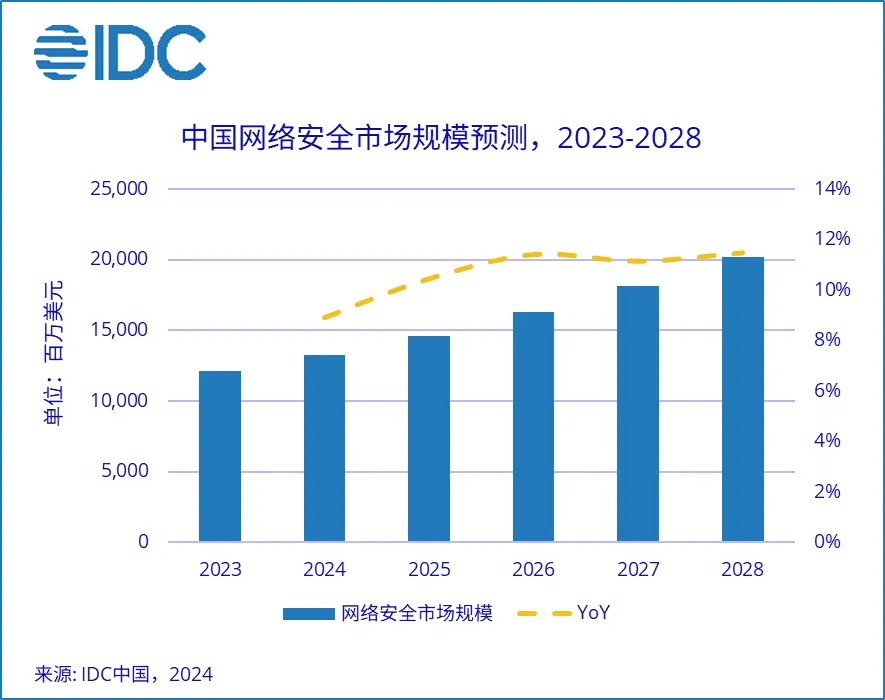

China Cybersecurity Market Insight

IDC forecasts that China's cybersecurity market size will grow steadily from $12.16 billion in 2023 to $20.2 billion in 2028, with a CAGR of 10.7% during the period. The future of China's network security market will be more mature in the overall technology market composition, security defence hardware equipment gradually cloud, network security software, and services market continue to grow, with a five-year compound growth rate of 12.8% and 12.6%, respectively.

Focusing on the Cybersecurity Hardware Market, compliance policies are a key driver as organizations and individuals continue to place greater emphasis on cybersecurity. At the same time, frequent threat attacks also drive the growth of network security hardware investment. IDC predicts that, in the face of more complex network threat environment and increasing compliance requirements, Unified Threat Management (Unified Threat Management) market share will continue to rise, with a five-year compound growth rate of 7.1% to become the largest submarket for hardware. Hardware firewall (Firewall) market is shrinking year by year, the share may be very little left.

In addition, in the network security software market, Information and Data Security Software (IDSS) has become the largest submarket for software with a five-year CAGR of 16.7%. Throughout the network security software market, on the one hand, businesses and organizations are placing increasing emphasis on data protection, and enterprises are increasingly focusing on ensuring the confidentiality, integrity, and availability of data, a trend that has led to rising investments in data security software; on the other hand, the increase in the number of telecommuting, mobile device access, and remote system access scenarios and their popularity, which has increased the demand for end-device security, will also promote the rapid development of this market. In addition, network security software combines artificial intelligence and machine learning technologies to automatically detect and respond to potential threats by analyzing massive amounts of data, improving the speed and accuracy of threat response, providing more comprehensive and effective security for enterprises, and bringing more innovation and opportunities.

In the Network Security Services Market, as defined by IDC, security services are comprised of Managed Security Services, Project Oriented Services, and Support Services. Services. Among the security segments, consulting services account for the highest share of the security consulting services market, expected to reach $2.2 billion by 2028, driven by the enactment of security regulations and the growing trend of data security consulting.

Industry Insights

From the end-user investment point of view, the government (Government), financial services (Financial Services), and telecommunications (Telecommunications) are still the top three industries of cybersecurity spending; the expenditure in 2024 accounted for 24.9%, 18.9% and 15.0%, respectively. Driven by the policy of "Regulations for the Security Protection of Critical Information Infrastructure", technology facilities in the government, financial services and telecommunications industries have a higher demand for cybersecurity, are more sensitive to the awareness of data protection, and are more forward-looking in terms of cyber attack and defence. Therefore, nearly 60% of the network security expenditure is from these end users. In addition, the policy to bring new points of opportunity affects the intelligent rail transportation industry. The gradual transformation of the manufacturing industry to smart manufacturing has driven the growth of cybersecurity spending. Protecting intellectual property rights, securing supply chains and data, and meeting legal compliance requirements are the key factors driving the manufacturing industry's investment in cybersecurity. The growth of cybersecurity investment in the high-tech and electronics industry is mainly due to its high reliance on information technology and data processing and the need to face the complexity and diversity of cybersecurity threats.IDC predicts that high-tech and electronics will be the fastest-growing industry for cybersecurity investment, with a five-year compound growth rate of 13.6%.

Business Size Insights

Business sizes under the IDC definition are categorized as Very Large Business (1000+), Large Business (500-999), Medium Business (100-499), Small Business (10-99), Small Office (1-9), and Consumer. In the cybersecurity market, end-users are still dominated by mega enterprises, accounting for nearly 70% of the total market investment. In recent years, with the popularization of network security awareness and the threat of frequent attacks, small and medium-sized enterprises’ network security investment has also been gradually enhanced; IDC predicts that the five-year compound growth rate of medium-sized enterprises will reach 12.1%.

Analyst Views

Yanghao Liu, IDC's China enterprise analyst, said China's cybersecurity market has been growing rapidly, driven by policy regulation and heightened data protection awareness. Affected by the epidemic, the government and enterprise budget tightening trend has not undergone a significant shift, the budget growth of the network security market generally slowed down or delayed, the demand side of the growth rate is relatively stable, the growth of China's network security market has slowed down. Advances in digital transformation, artificial intelligence and big models promote combining emerging technologies and cybersecurity to provide enterprises with more comprehensive and effective security. With the advancement of technology and changes in enterprise demand, the cybersecurity software market will usher in more innovation and opportunities.

IDC's Guide to Global Cybersecurity Spending

With accurate and high-quality forecasts, it provides users with a dynamic prediction of the development of the global AI and generative AI market for the next five years. Based on the continuous iteration of the global market situation, driven by various factors such as customer demand, data quality, and market development, this forecast refines the granularity of the industry dimensional data to provide 27 industry segmentation insights.

IDC Guide to Spending

It provides data support for IT vendors, industry users and investment/financial institutions in strategic planning, product development, IT spending and investment planning. Focusing on IT hot areas, the "Spending Guide" series of products predict market size and growth rate in multiple dimensions, helping vendors explore market potential, guiding industry users to conduct IT planning based on hot technologies and application scenarios, and helping investment and financial institutions make better decisions by analyzing the development prospects of specific markets.