IDC's Latest Cybersecurity Hardware Market Share Report Released

AI Become Driver for Cybersecurity Hardware Market

Beijing, April 21, 2025

In 2024, affected by the negative impact of the global economic downturn, the market size of China's cybersecurity hardware products reached 21 billion yuan, a year-on-year decrease of 6.5%, indicating a continued sluggish market trend.

IDC defines cybersecurity hardware as a series of technologies and products deployed in hardware form to protect users' internal network resources through policy enforcement and threat prevention. This specifically includes six major markets: Secure Content Management (SCM), Intrusion Detection and Prevention (IDP), Unified Threat Management (UTM), UTM-based Firewall (UTM FW), Traditional Firewall (Traditional FW), and Virtual Private Network (VPN). According to the latest IDC data, the market size of China's cybersecurity hardware is projected to reach 32.5 billion yuan by 2028.

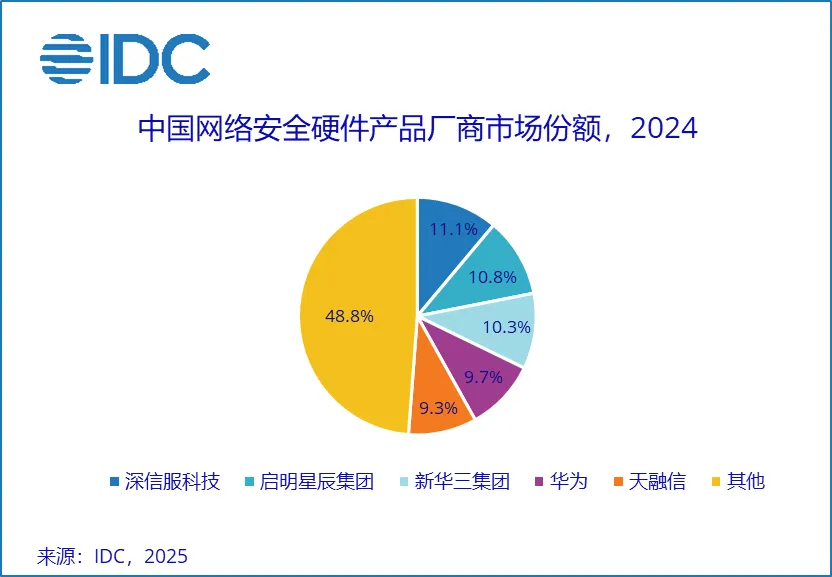

Against this backdrop, IDC officially released the research report titled "China Cybersecurity Hardware Market Share, 2024: Generative AI May Become a Key Driver for Future Growth in the Cybersecurity Hardware Market" (Doc#CHC53286424, April 2025) in April 2025. The report provides a detailed analysis of the size, growth rate, major players, and market and technology trends of China's overall cybersecurity hardware product market in 2024. The report data shows that in 2024, Sangfor Technologies, Venustech Group, H3C Group, Huawei, and Topsec dominated the highly competitive market due to their advantages in product technology and market sales. The specific market shares of China's cybersecurity hardware products in 2024 are detailed in the figure below:

In recent years, against the backdrop of the global economic downturn, the development of China's cybersecurity hardware market has faced significant challenges, as traditional cybersecurity hardware products are no longer sufficient to meet users' security needs. IDC provides the following recommendations to technology service providers from both market and technological perspectives:

Technology Side: In early 2025, the emergence of DeepSeek drove the widespread deployment of end-user generative AI applications, while the explosive popularity of Manus accelerated the rapid development of AI agents. These significant changes in the technology market will bring numerous opportunities to the cybersecurity industry. On one hand, GenAI will empower cybersecurity products, enhancing their efficiency and effectiveness. For example, integrating generative AI capabilities into firewall products will improve the creation and optimisation of firewall policies and rules, automate report generation, and enhance basic operational and maintenance capabilities, while also providing intelligent analysis and response support for firewall management platforms. On the other hand, the security of large models themselves has garnered widespread attention, creating a substantial incremental market for the cybersecurity industry. The gradual acceleration of generative AI application deployments will increase user demand for products related to large model security detection and protection. Currently, many internet companies, security vendors, and cloud service providers have already launched products and services focused on large model security, leveraging their existing product capabilities, such as large model application security firewalls and large model security risk assessments. In the future, developing security solutions tailored to large model scenarios will become an essential path for technology service providers to keep up with the trends of the times.

Market Side: Products in the cybersecurity hardware market, such as firewalls, intrusion detection and prevention systems, web application firewalls (WAFs), and virtual private networks, have been evolving for many years. Against the backdrop of a broader economic downturn, user demand for new and replacement products in this category has shown weak growth. To better adapt to market changes, technology service providers must, on one hand, continuously track new product technology trends, select appropriate marketing and promotion strategies, and focus on key hotspots to enhance product influence. On the other hand, beyond the traditional three pillar industries—government, finance, and telecom operators—providers need to expand into more upstream and downstream sectors, developing tailored industry solutions based on specific needs to achieve precision marketing.

Analyst Views

Wang Yiting, Senior Analyst of IDC China's Cybersecurity Market, stated that in 2024, the impact of economic downturn on the cybersecurity industry continues, with the Chinese cybersecurity hardware market experiencing negative year-on-year growth. The government has recently released numerous economic stimulus policies, which will alleviate the economic burden on various industries over the next 1-2 years, providing policy support for the recovery and growth of the cybersecurity industry. On the other hand, the explosion of large model applications will inject significant development opportunities into the overall cybersecurity market. For technology service providers, it is crucial to seize the momentum of large models to enhance product capabilities, develop new products for large model application scenarios, and quickly capture new markets. IDC will continue to monitor changes in this market.